what cities qualify for usda loan

To learn more about USDA home loan programs and how to apply for a USDA loan click on one of the USDA Loan program links above and then select the Loan Program Basics link for the. 100 upfront guarantee fee based on the loan amount.

Usda Rural Development Loan Temecula Ca Usa Home Financing

USDA loans are low-interest mortgages with zero down payments designed for low-income Americans who dont have good enough credit to qualify for traditional mortgages.

. See if you prequalify for personal loan rates with multiple lenders. Youll see a thumbtack. Choosing a home in a designated rural area is only the first step to qualifying for a USDA loan.

At this point the property address needs to be. The property also needs to. The United States Department of Agriculture guarantees the loans.

Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. The heavily populated cities are. Ad Check Your USDA Loan Eligibility See If You Qualify for 0 Down No PMI More.

Then enter the address of a property youre thinking about buying. That home will also need to be your primary residence not an investment or income-earning property. Your income needs to be within 115 of the median household income limits specified for your.

There are some mandatory requirements that must be satisfied for a USDA loan. It Only Takes Minutes to See What You Qualify For. Department of Agriculture eligibility map shows that rural development loans are available in many areas outside of the major cities.

Be without adequate housing. Once on the site just select single family housing on the left side of the page. Buyers can check local USDA availability by visiting the departments property eligibility tool plugging in an address and.

First go to the USDAs interactive map. Ad Easier Qualification And Low Rates With Government Backed Security. The loan is for homeowners who live in suburban or rural areas.

The programs also make funding. USDA Loan Credit Requirements. Click Now Apply Online.

The home must be in a rural area which the. Acquiring new or used permanently affixed storage and handling equipment. A 0 down home loan.

USDA provides homeownership opportunities to low- and moderate-income rural Americans through several loan grant and loan guarantee programs. Start your search by finding a USDA eligible home in a nearby locations. Using a USDA loan eligibility map is a breeze.

This includes minimum credit scores and other aspects of credit history. The current USDA mortgage insurance rates are. 100 upfront guarantee fee based.

A producer may borrow up to 500000 per loan with a minimum down payment of 15 percent. More than 97 of geographical locations in US qualify for an USDA home loan. Fast Easy Approval.

To make sure you will qualify for one youll need to meet the following criteria. They help very low-to-moderate income buyers become homeowners. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Currently areas must have 35000 or fewer residents. Ad Check Your USDA Loan Eligibility See If You Qualify for 0 Down No PMI More. The primary goal of a USDA.

Harleysville Pennsylvania is eligible for the USDA Loan program. The Best Offers from BBB A Accredited Companies. A Nationwide Non-Bank Ag Lender wFinancing Solutions for Farmers Ranchers Landowners.

See Official USDA Loan Requirements Choose Your USDA Loan Lender for 0 Down. Ad With AutoPay and for specific loan purposes. Have functional heating and cooling systems 2.

You will then need to accept the Property Eligibility Disclaimer. So if your income is too high to qualify. It may benefit you to use a USDA loan calculator to see if your income will qualify for this type of mortgage.

Offer easy access from a paved or al. To qualify your household must have an income below 80 percent of the median income for the area. USDA property eligibility depends on whether you live in a rural area or a cosmopolitan area.

Department of Agriculture USDA offers a great financing option for both first-time and repeat homebuyers. The general requirements to qualify as. Be able to afford the mortgage payments taxes and.

Ad Minimum of 50 Acres w Expedited Loan Process No Annual Fees. It Only Takes Minutes to See What You Qualify For. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

More importantly your income.

Usda Home Loan Mortgage Eligible Locations In Florida

Henrico County Virginia Usda Eligibility

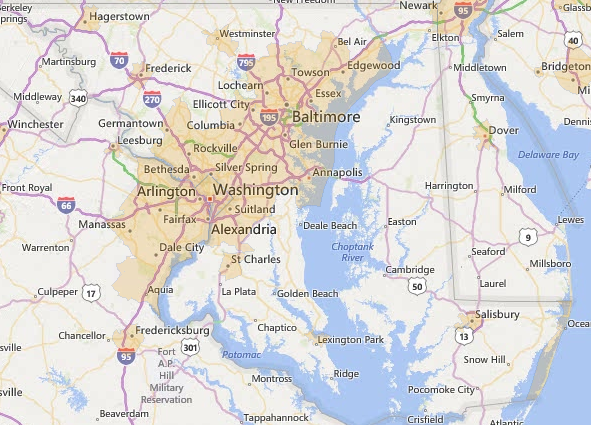

Montgomery County Maryland Usda Eligibility

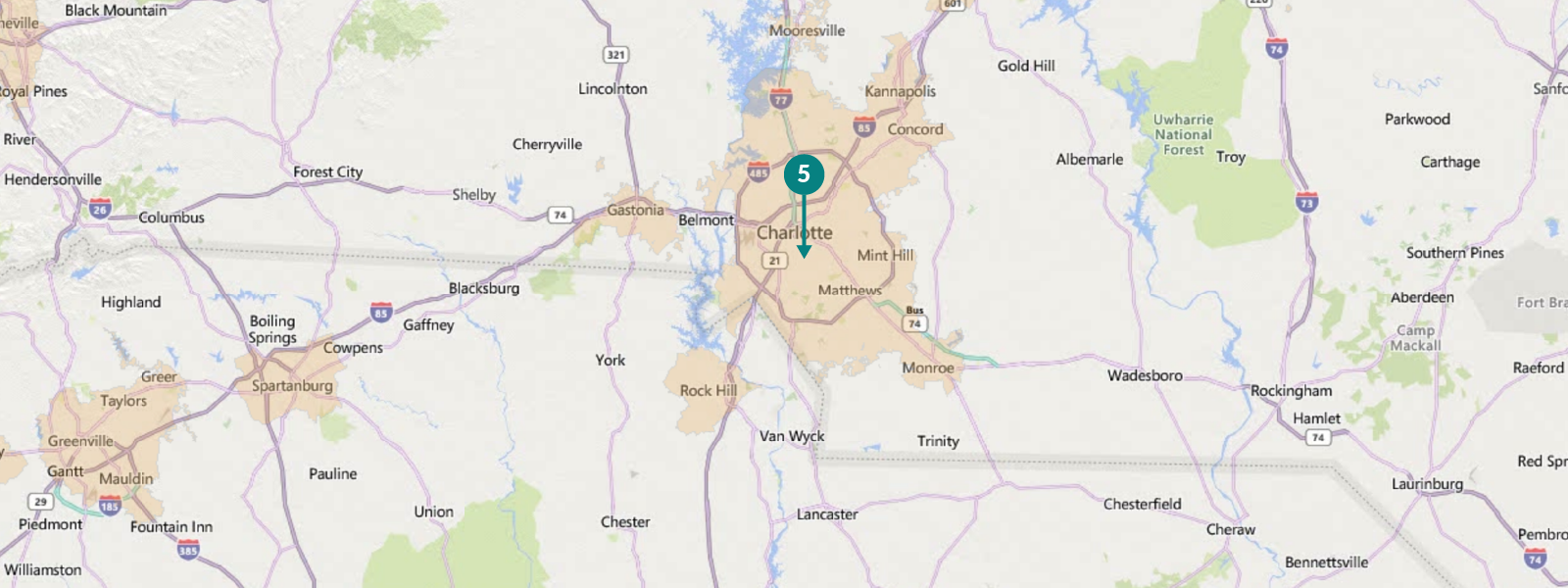

Usda Loans Eligible Geographic Areas Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Stafford County Virginia Usda Eligibility

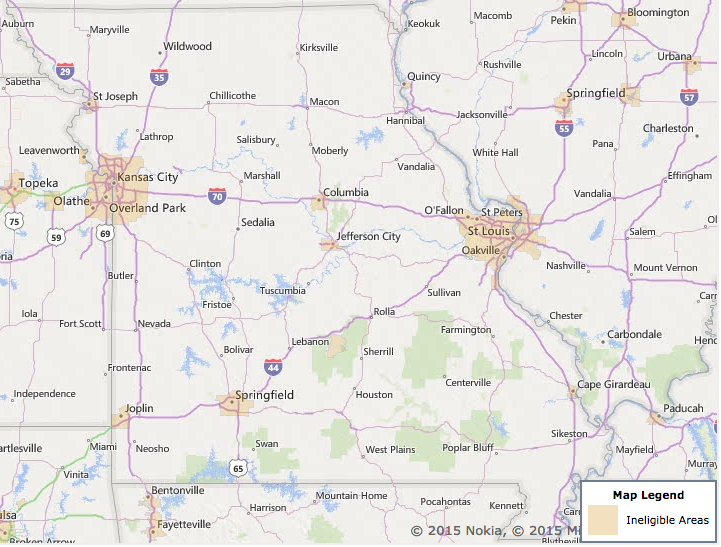

Missouri Usda Loan Eligibility Information Application

Chesterfield County Virginia Usda Eligibility

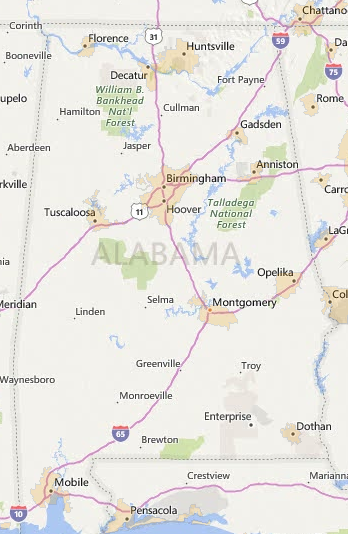

Alabama Usda Loan Information And Application Usdaloans Net

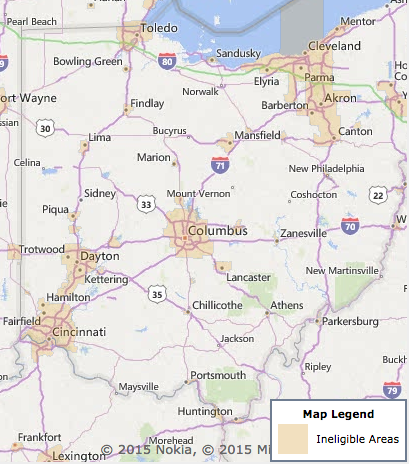

Ohio Usda Loan Eligibility Information Application Usdaloans Net

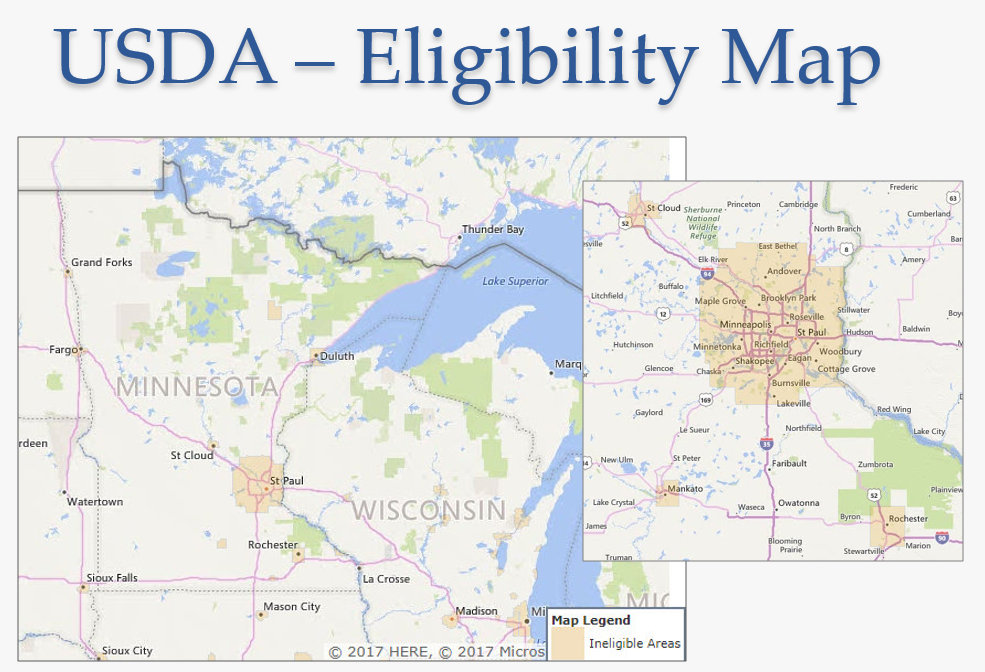

Usda Rural Development Loans Mn 100 Financing Zero Down

Usda Loans Eligible Geographic Areas Mortgage Rates Mortgage News And Strategy The Mortgage Reports

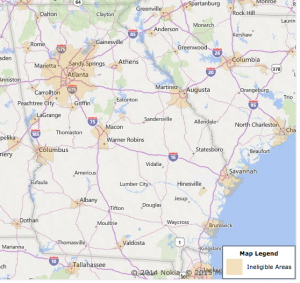

2022 Georgia Usda Loan Requirements Usda Mortgage Source

Prince William County Virginia Usda Eligibility

Baltimore County Maryland Usda Eligibility

Maryland Usda Loan Eligibility Information Application Usdaloans Net

Montgomery County Usda Rural Development Mortgage Loan

Usda Eligibility Maps How To Use In Your House Hunt

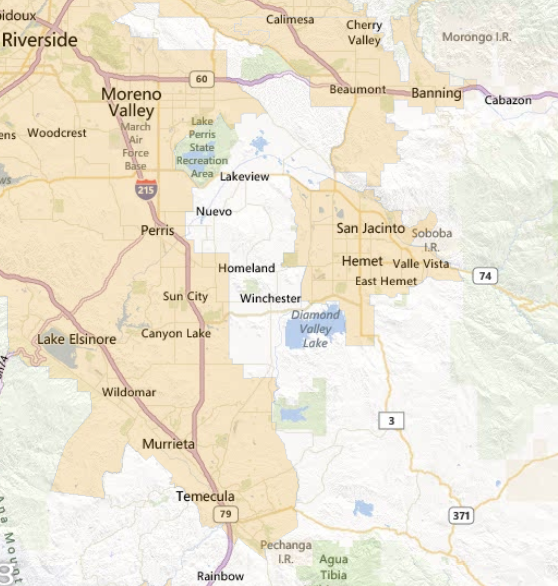

Usda Loan Eligible Rural Areas In Riverside County Changed

New Usda Eligibility Maps Are Effective On February 2nd 2015